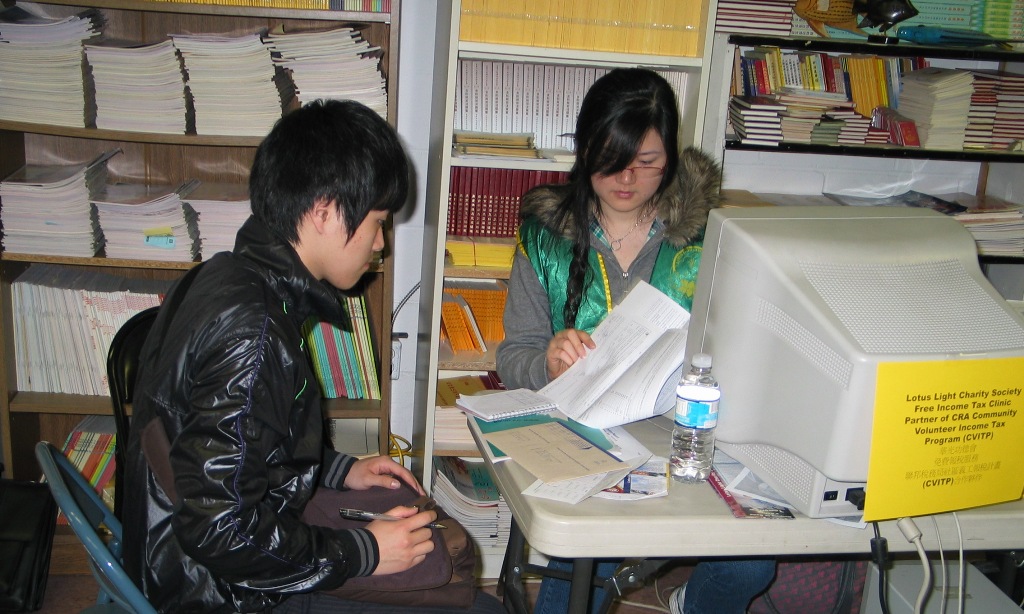

Lotus Light Charity Society, in conjunction with the CRA Community Volunteer Income Tax Program (CVTIP), is pleased to offer free income tax return preparation for low-income residents, seniors and students and newcomers to Canada.

Eligibility:

- Ages: 18 year(s) and up

- Single person with income under $25,000;

- Single parent family with income under $30,000

- Married or common-law couple with income under $35,000

- Add $2,000 per child (to $35,000) for basic family income

- Interest income less than $1,000

Free Tax Clinic will not handle tax returns involving: deceased persons, rental income, business income, self-employment and investment income.

Please bring your T-slips, Social Insurance Number, valid ID (health card/driver license), medical receipts, child care receipts and last year’s tax return with “Notice of Assessment”, and new tax return form you have received. For married or common-law couples, an authorization form is required with spousal signature.

Tax Clinic hours:

Friday and Saturday afternoons, 1:30pm – 4pm

March 16 – April 28, 2012.